VeTokenomics or Vote Escrowed Token Economics - one of the more recent innovations in blockchain tokenomics and protocol governance. Tokenomics and intelligent, well-designed incentives to attract and hold users & investors for the long haul will enable more solid protocols to outperform other projects & networks that do not have a smart ecosystem around their token.

Utility, not incentivization for pmf

However, token functionality, and tokenomics are both evolving and we will see an evolutionary pathway here - weaker models will become extinct, newer models will emerge, and stronger value alignment driven models will survive, and thrive. Widely used reward & token incentivisation models to force fit product-market convergence will probably not work anymore. Token design will become more multi-functional in approach - utility and governance will need to work in tandem to energise a protocol’s growth flywheel, and impact the economic value of the protocol token. Rights, access levels, & reputations attached to tokens will add on layers of further utility.

Thus, in such an evolving token ecosystem, one of the key components is the governance system, and that’s where ve can ensure that users (voters) have the protocol's best interests in mind and must align the incentives for the token holders and the protocol.

The prominent one token one vote model of tokenomics is riddled with problems and open to abuse. Although novel in theory, they are able to attract users over the short term who only act out of self-interest, hence making the protocol unsustainable. Whales can provide massive amounts of liquidity and capture the majority of the native token emissions, then proceed to dump these tokens, crashing the price of the token and sabotaging the project. This goes against one of the basic aspirations of crypto which is to level the playing field for everyone and provide opportunity equity.

The opposite can also be true as in the case of Juno where the token holders rallied to vote for basically the deletion of almost $100 million in value held in $Atom (native token of Juno) by a whale. According to them, the whale had accumulated the tokens through unfair methods, hence shouldn’t be allowed to retain. After multiple proposals and going back and forth, they enforced the whale redistributing 50% of the tokens to the community and 50% back to the clients on whose behalf he was holding the tokens. It can be debated which side is on the right here but at the end of the day, this is a strange case which portrays how the one token one vote model can also lead to a mob mentality flying in the face of the spirit of governance.

Furthermore, this model does not align the interests of the users with that of the underlying protocol in the long run. A person or an entity holding a majority of the tokens has the entire network in their palms and can swing the direction of the protocol in any way that benefits them. Governance tokens are primitive and don’t offer any value other than simple governance , making them unattractive in DeFi.

What is VeTokenomics?

VeTokenomics aims to solve these issues and has promise in DeFi. Vote escrowed tokenomics allows token holders to choose to lock in their tokens for a specific period. The longer the lock in period, the more weight the tokens get in governance voting, staking rewards and voting on boosting liquidity pools. It also reduces the token’s supply, thereby reducing selling pressure. The underlying idea is simple and mostly sound, those who are willing to lock in their tokens for the longest time are the ones who believe in the protocol the most. Thus, they deserve to reap more benefits and have greater say in governance issues.

The flow diagram below illustrates the mechanism through which VeTokenomics operates. Initially, the user locks in native tokens and receives veTokens which are weighted according to the period of the lock in. The user then enjoys greater voting power, more control over emissions and boosted rewards which is directly proportional to the lock in period.

VeTokenomics at work: Curve.fi

Curve.fi is the pioneer of the VE model and introduced it in 2020. Let’s not talk about UI UX here! Their work has been instrumental in the DeFi space - aiming to act as a stable coin swap and minimise slippage. A stable coin issuer who owns substantial $CRV (Curve’s native token) can direct emissions into their stable coin’s pool, by locking in. This allows them to offer higher APRs, attracting more liquidity. Thus, resulting in tighter pegs and minimised slippage, making it a very desirable stable coin swap.

Curve allows users to lock in their tokens from a period of 1 week to a maximum of 4 years. According to this, their tokens are assigned a weight, the longer the lock in period, the more the weight of the token. They enjoy reward boosts and greater voting power. This means that those that lock the protocol token longer accrue higher rewards, with up to 2.5x rewards boost for those locking in 4 years.

A protocol which wants to maximise its own benefit is incentivised to lock in their $CRV tokens for the full 4 years. By doing so, they can enjoy more voting power using which their LPs could be boosted for offering higher APRs, leading to greater user growth. Curve benefits through the same because of lesser sell pressure and more stability on their base token. This brings about synergy between the DAO and the token holders.

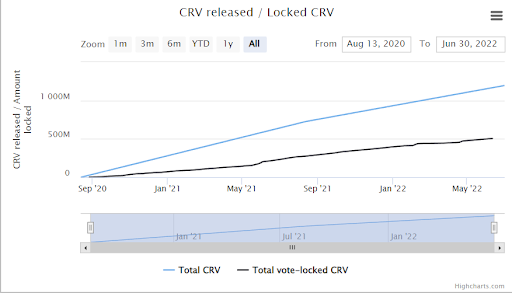

The table below shows the number of $CRV tokens in circulation, % of $CRV tokens locked in and their average lock in time. The graph demonstrates the growth of its users and a growing community which has placed its trust on the DAO for the long run. With almost 50% of tokens locked in and an average lock in time of 3.61 years, it appears that the VE model has been an immense success for Curve and has users willing to put their trust into the DAO.

Source: https://dao.curve.fi/releaseschedule

Advantages of VeTokenomics

The VE model has inherent advantages leading to its adoption by other protocols and DAOs. An experiment on the Fantom blockchain of a ve(3,3) token which combines vote escrowed with the (3,3) mean utilised by Olympus DAO was tested or is still under consideration. Hundred Finance has $veHND, Pickle Finance with ‘Dill’, and Ribbon Finance, all currently use some form of the ve model.

Where VE model scores is in aligning incentives for the protocol and the token holders. The blockchain industry is still in its infancy and needs lasting long-term projects to prove the promise of its technology. The VE model can help in doing so as it prioritises long term health of the protocol. It introduces positive feedback loops that mitigate selling pressure on the main token.

The graph below shows the total number of $CRV tokens in circulation and the total $evCRV tokens. It is interesting to note that the rate of locked $CRV is growing faster than the rate of supply which has a positive impact on the demand and supply dynamics and should support the price over a long term, which historically most DeFi tokens haven’t been able to do. This also proves that Curve has successfully incentivised token holders to lock in their tokens through greater voting power, boosted rewards, boosting LPs and discounts. It is a testament to the success of the VeTokenomics.

Source: https://dao.curve.fi/releaseschedule

Another issue the VE model addresses more efficiently is DAO participationy. Since the tokens are weighted directly to their lock in period, it gives passionate users who might have fewer tokens a way to have their voices heard on governance related issues in a more equitable fashion. Moreover, regular users are incentivised to lock in their tokens for longer for better yields, so the security of their tokens depends upon the long-term health of the protocol in which they are now tied into. Thus, even small users will take more interest in governance issues unlike other DAOs.

Drawbacks of the VE model of Governance:

The drawbacks of VeTokenomics are minor, although they should be kept in mind while designing a protocol. The drawbacks revolve around the principles and ethics of crypto and the loopholes in game theory. VeTokenomics relies on game theory where the best outcome for all token holders is for them to stake their tokens and hold. This makes the protocol more stable which attracts more users. Ultimately increasing the price of the token and benefitting the ones who staked and held.

However, this also allows whales to consolidate their control over the project. Since whales are richer and have less liquidity needs, they can lock in their tokens with less hesitation as compared to non-whales. VE protocols run the risk of whales gaining control over them. Moreover, protocols with greater liquidity can take over control of the DAO and make it difficult for newer protocols to grow and succeed. This could go against the basic principles of crypto.

Another loophole in the game theory of VeTokenomics comes with the lock in period. Let’s take a look at the TempleDAO to understand this. It had a lock in period for early investors. Each user had to lock in their tokens for the same period from the time of purchase. However, the purchase time of users was different which meant that some early investors would unlock their token before others. During the initial stages, users could only buy the token but not sell. Since there were no sellers the price of the $Temple (Native token) shot up. Now, when the first investors had their tokens unlocked, they could either look out for themselves by selling the tokens at a great profit or act out of good conscience by staking and holding. The rational choice for them was to sell and make good money instead of risking a rug pull or the project failing. Later, the users whose tokens unlocked after this were more incentivised to sell their tokens as a dump was evident. This led to a negative spiral and the price of the token crashing.

VE tokens are also subject to developer abuse, who could sell their tokens while others have theirs locked in. Whales could also abuse this feature by locking in their tokens from their known public wallets but selling on their smaller private wallets. The opportunity cost of being locked in for as much as 4 years in the crypto market is also quite high.

Way Forward: Hybrid VE models

We also have to take into account that it’s going to be challenging to persuade the majority of users to lock in their tokens for such long periods after witnessing the recent crisis of being illiquid - even though it was on centralized entities. Although VeTokens are an upgrade to the presently prominent form of tokenomics, it would be wise to look for other iterative models as well, keeping in view a protocol’s specific mechanism design choices.

To address the lock in dilemma problem, a hybrid model could yet allow premature unlocking of tokens, but with an early unlocking penalty on a reverse sliding scale vs proportion of unlock, and also basis locked time horizon.

Protocol revenues: Importantly, as protocol revenues become one of the most important metrics of a protocol’s value, there has to be a sound mechanism of distribution of the revenue, and in a way which also aligns participation. Further, the free rider problem could also be addressed by by factoring contribution into designing protocol revenue distribution mechanisms. A hybrid VE model where protocol revenues are shared not only basis lock ins, but also on contributions made to DAO provides the framework for value alignment & distribution that will ultimately result in higher demand for the protocol token.

The basic VeGovernance model might not be perfect, but its design encourages symbiotic behavior. Going forward, protocol architects will have to find ways to align specific design considerations emerging from the protocol’s use cases, with add-on governance design, early exit options, and revenue distribution frameworks on top of the basic Ve model architecture to create Ve hybrid models that will drive long term positive loop token economics.

References

- https://beincrypto.com/venomics-taking-over-defi-as-new-model-for-earning-more-rewards/

- https://dao.curve.fi/releaseschedule

- https://www.coindesk.com/learn/what-is-tokenomics-and-why-is-it-important/#:~:text=A%20portmanteau%20of%20%E2%80%9Ctoken%E2%80%9D%20and,like%20what%20utility%20it%20has.

- https://mirror.xyz/0x071B76df4a05Fb162569930aB82d8d265Bb8A497/GzzvxvNFeTjH9au6cllJ_4ffshySn3M3iAmKe34sxdw?utm_source=tldrnewsletter

- https://twitter.com/_PorterSmith/status/1505960487162425347?s=20&t=Jd3rfGA1CI7ZvPuFOvNLPQ

- https://economics.mit.edu/files/19457