TLDR: This article shares personal reflections on digital assets and macro portfolio shifts. As Bitcoin approaches $100K, and crypto markets exceeding $3 trillion, whilst traditional markets face stagnation; digital assets are becoming an inevitable component of future wealth creation. driven by wider decentralized technology adoption, DeFi, tokenization, and beyond.

This is not financial advice in any form. And remember, digital assets are highly volatile.

A two decade Transformation reaching Critical Mass

Bitcoin is on the brink of USD 100,000, let that sink in. A transformation which started a decade and a half ago, is reaching scale & velocity and will transform financial markets and economic theories within the next half decade. Not surprising to many of us who have been immersed in this space. Yes, Trump and the US elections have catalysed the velocity, but the trajectory was visible.. It’s not just the newness of the asset and its relatively lower liquidity, and we explore this in relation to stocks and gold, but also the technology and its impact on market opacity.

There’s serious talk of strategic reserves of nations being restructured, and several sleeping countries, or nations sitting on the fence will start moving now as well, at least I hope so for most progressive countries. The broader crypto market has crossed the $3 trillion threshold. This is no longer just about speculation; it's about the future of value.

Amidst all this, I’ve been reached out to by friends, family, and even some unfriendly folks too, just like anyone immersed in the space would be, with the common question, ‘Should I buy Bitcoin now? And should we buy other crypto tokens?’

I am no financial advisor, neither have we built an advisory platform - and my answer is always the same: I’ll share how I’ve approached this space — why more than 25% of my portfolio is already in crypto, and why I believe allocating 1-5% to digital assets could be the starting point of a transformative journey for anyone - from an investor, to a passive participant in the space, to someone thinking about how their portfolio will look like in the next five to ten years in a really fast changing financial world. My belief in the transformative technology of crypto and blockchain is unwavering, and the way I especially see the convergence of AI and tokenization. That this technology is spawning the next generation of crypto - let’s refer to that as digital assets

Traditional finance: a Diminishing Yield story

The evolution of digital assets has to also been seen in the context of where legacy financial markets stand today and where they are moving. Traditional financial markets are grappling with the weight of low-growth forecasts. Inflationary, dollar minted driven demand and growth is not sustainable and the party is over. Goldman Sachs predicts a modest annualized return of just 3% for the S&P 500 through 2034. This figure is significantly lower than the historical average of approximately 11% over the past century and contrasts sharply with the 13% annual return achieved over the last decade.

The double-digit equity returns of the last bull markets are history, replaced by a focus on wealth preservation rather than wealth creation. But here's the rub: preservation alone won't suffice in a world where inflation eats away at purchasing power. Growth is essential, and the next engine for that growth is not going to be from traditional asset classes. In fact even for preservation of value, the premier digital asset ie Bitcoin is a reality.

The Matrix of the Networked Era Asset Allocation

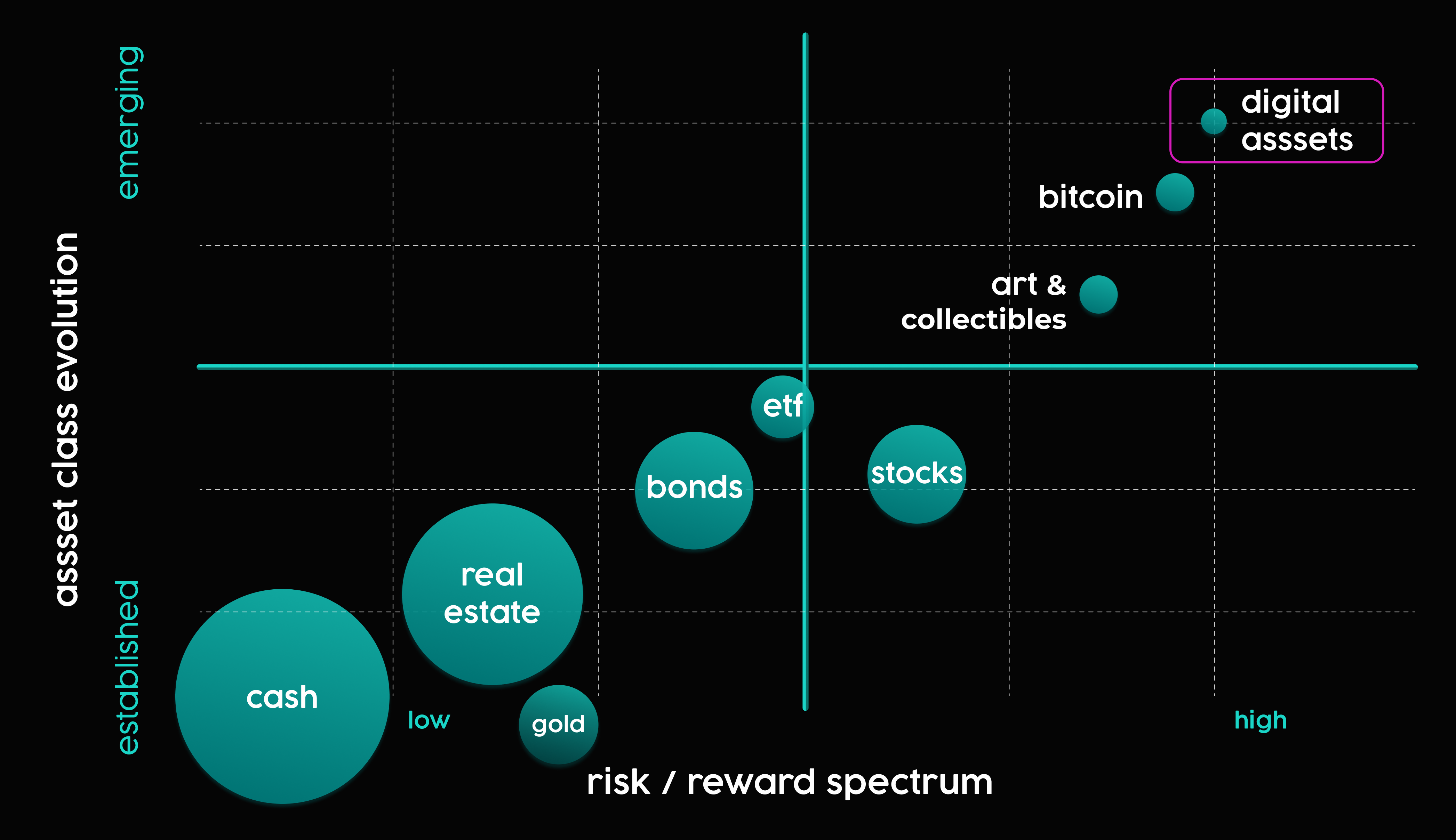

Growth is essential. And one way I visualize asset allocation in this context is through a matrix created on a one axis covering Traditional vs. New Asset Classes, and another axis on a Risk vs Reward spectrum.

This is just a thematic visualisation of how markets look like now, or how a typical legacy financial investor's portfolio may look like now - mostly a bunch of equity, bonds, real estate, some gold, cash instruments, and if at all, may be a teeny bit of bitcoin. However, in the next five to ten years, the market and the asset allocation will look very different, with the bitcoin and digital assets bubbles grown significantly. Bitcoin is also a digital asset, but really deserves its own place as a store of value, and a portfolio visualisation will be amiss to club Bitcoin and all crypto and tokenized assets together as digital assets.

In this framework, traditional bonds and blue-chip equities sit safely in the lower-left quadrant, while high-risk digital assets like altcoins and emerging utility tokens occupy the upper-right. This is how I vizualize my asset allocation - and I see digital assets becoming much larger in their share. What’s the number in another five to ten years - 30%, 40%, 50% or 75% - that’s the moving piece and time will tell.

And where would I have started if I had to begin my crypto journey today? The sweet spot for any portfolio is finding balance across these quadrants. For me, I think if I were to start today, it would be a straight 5% allocation and that would move up over time.

Digital assets are no longer a fringe bet; they’re becoming a necessity. Even a small starting allocation of 1-5% can provide exposure to this fast-evolving sector while keeping overall portfolio risk in check. The world is shifting toward a future where digital assets complement traditional portfolios. Tokenization, DeFi, and utility tokens are the next growth engines, offering opportunities that traditional markets no longer provide.

Digital Assets: Beyond Bitcoin

Bitcoin’s dominance, currently around 60% of the total crypto market cap, is a foundational story. But the functional innovation in crypto lies beyond BTC. For example, in utility tokens, which are the the lifeblood of decentralized networks, enabling governance, payments, and resource allocation within blockchain ecosystems. Decentralized Finance (DeFi) protocols facilitating automated market making, asset management, lending, borrowing, and earning yield through liquidity provision, yield bearing stablecoins, and multiple other aspects ranging from sound and solid financially robust structures to esoteric, near ponzi level instruments. And not to forget digital assets that are also driven by culture, like NFTs and memes, depending on where one is on the spectrum and sees these. Point is, digital assets beyond bitcoin will be an equally important play and will only increase in its overall contribution as the asset class grows to 10T .

Further, tokenization will push the circumference of the digital assets sphere multifold. Larry Fink famously said that all financial assets will be tokenized, and I couldn’t agree more. Whether it’s a bond, a piece of real estate, or even a work of art, blockchain technology is breaking down barriers to ownership and access. The current reverse phenomenon of crypto assets being wrapped in ETFs and getting mainstream capital in and also millions of new users into crypto is a gateway, ultimately the flow of asset wrapping will be the other way, where existing financial asset classes will all get tokenized and be available on public, permissionless blockchain networks.

This is important for me and how I vizualize the composition of my digital assets. Why is this important to understand? It’s because I think that digital assets play or participation in my portfolio has to be almost equally weighted between bitcoin and other top, highly innovative crypto tokens, especially crypto structured products.

Are Digital Assets for Everyone?

And the answer is NO.

This is not just a new asset class, but an asset class built on a new technology, a new culture that attracts bot ends of the spectrum - from deep thinkers, researchers and builders, to astute financial investors, to speculative punters and scam artists.

Digital assets come with real risks, and moreover, come with a volatility that could cause stress for many, especially tradfi investors, who will be baffled to see how crypto investors just get on with their daily lives even when their portfolio went down by 50% over a few days or weeks. Crypto markets are volatile and unpredictable and you could see drawdowns reaching 20% very quickly.

Further, the technology is new in many ways; tokenization built on smart contracts could be vulnerable to security hacks and put assets at risk. On top of that, the user interface of crypto could be clunky too, and many purists in the space advise for self-custody ie holding your own crypto assets in your own wallet - either hot or cold, depending upon quantum and transaction frequency. This introduces some lack of ease as one has to deal with seed phrases and browser extensions. Larger macro risks in the form of regulatory uncertainty also remain.

Does that mean there are just too many hurdles - the answer to that is conversely also a no. Several aspects are evolving fast and multiple mitigations (ie security audits, KYT monitoring) or tech advancements (ie account abstraction), or decentralised asset management are addressing these issues. Clearly, it's an asset class which needs a level of understanding, or at least a wide level of risk tolerance.

Final Thoughts: Adapt or Be Left Behind

Having said that, we’re no longer standing at the crossroads of a financial revolution, we’re already walking that fork. Only, its not a fully divergent fork, but one that will run parallel as the new elevated expressway, only, no toll gates this time around. The integration of digital assets into mainstream portfolios is no longer a question of ‘if’ but ‘when’. As I've said, this may seem aggressive, it’s a reflection of my personal conviction and where I stand.

The future belongs to those who adapt, and digital assets are the bridge to that future.

*Disclaimer: This article represents my personal views and experiences. Always conduct thorough research before making investment decisions.