Bitcoin ETFs are being launched now - Is this the gateway for future mainstream adoption of onchain asset management?

Exactly 15 years back, on Jan 11, 2009, cypherpunk Hal Finney introduced Bitcoin to the world with his tweet. Finney was the first to mine Bitcoin, besides Satoshi - the pseudonymous creator of Bitcoin. Finney predicted that one day bitcoin could be valued at $10 million per token.

On Jan 9th, Bitcoin ETFs (Exchange Traded Funds) were approved by the US Gov SEC. And this recent approval of the Bitcoin ETF has sent ripples through the financial world. Whilst Bitcoin is designed to catalyze a new financial system, it seems a bit ironic that its adoption by mainstream Wall Street finance is a cause for much cheer. Essentially it means the same intermediaries on the street will package Bitcoin into a fund, add fees, and sell it to the public in a legacy financial system.

>> Still, why is this a big deal?

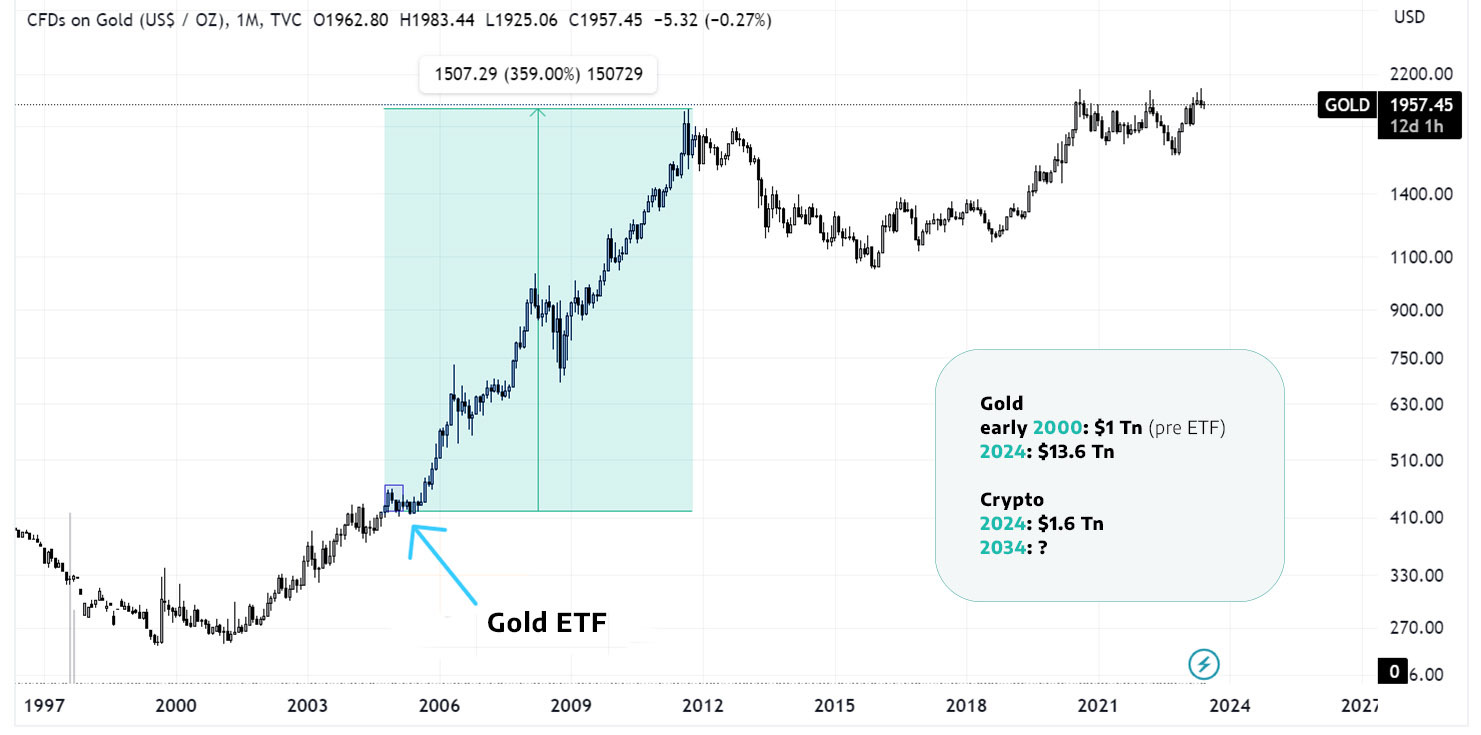

For that, let’s look at Gold. In the early 2000s, the introduction of Gold ETFs revolutionized the precious metals market.

The first gold ETF was launched in 2003, in Australia, and then subsequently by the behemoth Blackrock in the US. Within 10 years after that, gold as an asset class grew more than 10x. And, since then, gold has grown from $1 Tn to $13.6 Tn today.

The power of big and fresh liquidity in a new asset class cannot be underestimated. And that is why, the approval of BTC ETFs in the US is a big deal - it’s mainstream adoption. The entire crypto and digital asset class will see an order-of-magnitude expansion in the next decade with the flow of fresh new liquidity.

But remember, gold is not programmable, but crypto is programmable money, and that’s where its power comes in as a foundational technology to redefine financial systems. When this programmability, or tokenization, is coupled with mainstream liquidity - the future of finance envisaged by DeFi becomes a reality.

Tech, finance & decentralization going together can pretty much form the pipeline for wide-ranging impact. Case in point: in 2022, stablecoins settled over $11T on-chain, compared to PayPal at $1.4T, or even Visa.

So, whilst crypto is ultimately about a new financial system, a decentralized financial system or DeFi, that democratizes access and is built on the philosophy and technology of decentralization, self-custody, and permissionless, ETFs are sort of inconsistent with this. However, the convergence of legacy financial systems and DeFi in many areas is welcome - new liquidity is one such area. So, this convergence with mainstream via ETFs is hugely positive.

And, soon the way mainstream users interact and manage their digital assets lifecycle will evolve, it will be on-chain, in a self-custodied framework, directly on smart contracts, and via automated code-governed structured transactions that will make it simple yet well-informed for users. On chain decentralized asset management.

Bitcoin ETFs are just a gateway!