Those of us who’ve been orange pilled and have immersed in crypto as a technology, and understand it as not just another asset class, but a completely new financial system, have come around to deeply appreciate the genius of Satoshi.

Bitcoin (& genuine crypto, not the shilly scams that dot the space) has had its vicissitudes in its 14 year existence. Various times, its seemingly close correlation to tradfi (traditional finance for the non-crypto folks) markets has been perceived conveniently & bitcoin as an alternative has been questioned. But now, we clearly see the decoupling of bitcoin from existing financial systems. This is what Satoshi had conceived and designed bitcoin for. Its not just a store of value, it’s a new financial system.

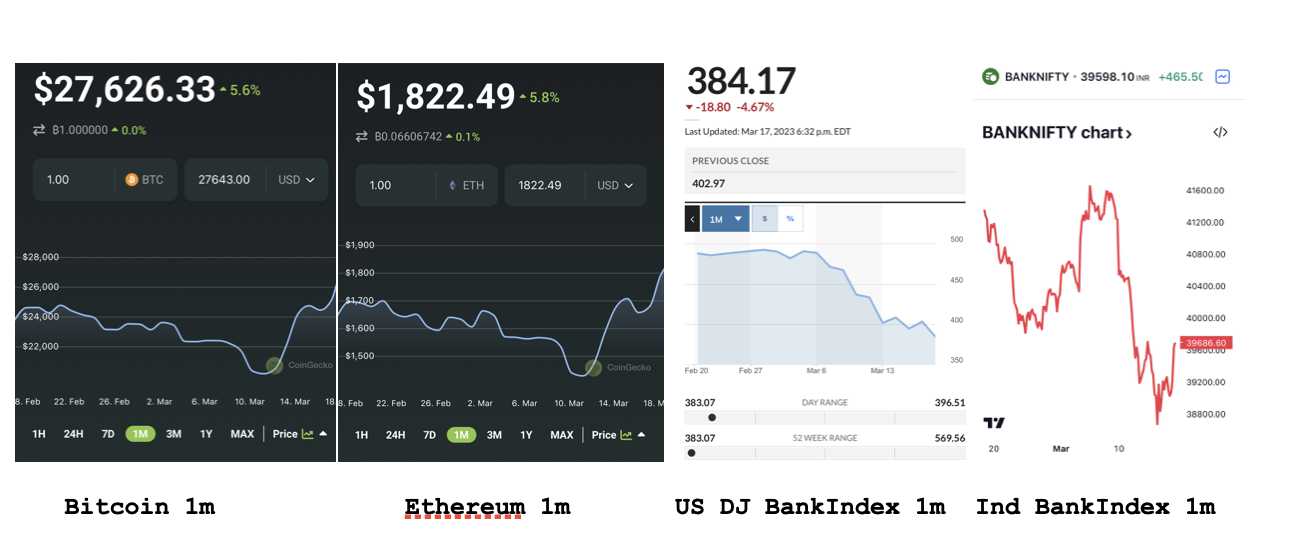

The stark movement of bitcoin (and even ethereum, on which much of decentralised finance is built on) vs bank indices (which represent current financial systems) in opposite directions is an early indication of the decoupling of bitcoin, and crypto as an asset class. And this is not just the US bank index, but also the Indian counterpart. The divergence will expand further in the long term, as more capital moves to decentralized, self-custodied money. Tatiana Koffman, who calls the systemic decoupling ‘the great reset’, shares her perspective here in this insightful piece on the need for moving away from centralized institutions: https://www.coindesk.com/consensus-magazine/2023/03/13/bitcoin-was-built-was-for-this-moment/

It’s perplexing that wise souls like the governor of the RBI continues to berate crypto and has recently even cited how crypto poses significant risk to banking systems.

We have to listen to the woes of people. The decoupling of bitcoin and movement of capital, and that’s not just institutional, but possibly large numbers of individual investors, this establishes the very real concern people have with existing financial systems and centralised structures. Decentralised finance has the foundational architecture to address the risks of centralised concentration and opaque counter-party contagion.

In fact, contrary to the assertion of the governor, if anything it was the banking system which posed a risk to crypto. Stablecoins are the rails of decentralised finance, and it is ironic that a leading stablecoin, USDC, depegged because 5% of its USD backing reserve was stuck on Silicon Valley Bank. Fortunately, its back to its 1:1 peg, else a tradfi contagion would’ve impacted DeFi.

Further, looking into the genesis of the SVB crisis, and actually how there’s a gaping $600bn hole in the banking system, Balaji has delved deep and written extensively to establish how the crisis has been created by Federal Reserve in the first place, with guidances that are also followed by banks, and were fully misplaced. https://twitter.com/balajis/status/1635978647533412354?s=20

Again, to the ones who point to the crypto crisis and cash in the last 12 months, I wouldn’t belabour the point that the likes of FTX, and the numerous crypto companies & funds that imploded and caused a crisis in now just digital assets markets, but also threatened tradfi disruption - all of these were centralised entities, just like banks (again, not getting into the nuance of an exchange that also holds client assets directly instead of a third party custodian). And such structures are inconsistent with crypto in its design structure of being decentralised and permissionless. So, these collapses were just reflective of poor design, a copy pasta of tradfi models.

When I wrote a recent thesis on ‘asset management design in a tokenised economy’, I used the analogy of how there’s a clear & present opportunity to build the decentralised Schwab of Web3. Schwab was a good analogy because of the way it democratised access to equities, and used technology extensively for this, bringing online trading for the first time, and also drove down costs. Charles Schwab’s shares have taken a hammering like never before, owing to its exposure.

The point is simple, no centralised entity is secure, anywhere. Decentralisation is vital. Self-custody is vital. Transparency is a feature, and not opacity.

Everyone, from individuals, to startup & company treasuries, must park a proportion of their assets on a platform based on the architecture of decentralisation, self-custody, permissionless and full transparency. If you haven’t then do so progressively now. The decoupling is underway.

[This is not financial advice or anything of that sort, just coming from a techno-philosophy perspective.]

About the author

Sri is a second time founder who's building an alpha

discovery protocol at the intersection of Web3 & crypto. He

earlier founded Milk Mantra, a purpose driven premium

consumer food co in India, which was India’s first

agri-foods startup to be vc funded, going on to become a

leading brand in the east. Sri is a fellow of the Aspen

Institute and is also a Yale World Fellow.