TLDR:

Liquid staking has cornered a big chunk of DeFi TVL - standing at USD34 Bn. And In just 8 months, Re-staking has grown from zero to $6.1bn. Blockchains like Ethereum which operate on Proof of Stake, rely on validators for transaction processing, network governance, & security (broadly). Staking in crypto allows users to 'become validators' and passively earn rewards by staking their native crypto coin (Eth for Ethereum), thus optimizing yields on idle longer term digital assets. When they do so, they lock in the assets, hence lose access / liquidity. Unlike traditional staking, liquid staking addresses the issue of locked-in assets by providing users with a new token, known as Liquid Staking Token (LST), that represents their staked amount.

LSTs can be traded, used as collateral, and participate in various DeFi applications, providing liquidity and flexibility. DeFi innovation can be laddered up via this mechanism. Restaking involves using LSTs to enhance the security of other networks, contributing to a pooled security model.

We explore Liquid Staking in greater detail, to simplify it for a new user, and also delve into Re-staking & Eigen Layer, for a bit more advanced exploration. EigenLayer is a protocol built on Ethereum that introduces restaking, a new primitive in crypto-economic security that enables the reuse of ETH on the consensus layer. And we also touch upon how wider & easier access can be made possible via LST aggregation vaults.

As such, users should stay informed about opportunities and risks from ongoing developments in the fast paced DeFi world.

What is Staking ?

“Free Money ?”

Well not entirely and here’s how it works:

One method for individuals to passively earn with their digital assets, without the need to sell them, is akin to the traditional banking model of earning interest on fiat money deposited into a savings account. In this analogy, the bank takes the deposited funds and lends them to others at an interest rate, with the account holder receiving a small portion of that interest as a return.

Similarly, in the crypto and blockchain space, users engage in a practice known as "staking," where they commit a portion of their assets to the blockchain (or a protocol). This staking process involves a system of rewards and penalties based on the staked amount, contributing to the strengthening of the underlying blockchain or smart contract.

>Why it secures: Proof-of-Stake blockchains keep the network secure and validators honest by requiring validators to stake their tokens. If validators act maliciously or incompetently, they lose their stake and access to the network through a process called “slashing.” This forces the validators to do their jobs properly. There are many different variations on how this general process works, but that is not important to us right now.

>Financial security: The benefit of staking lies in the relatively lower risks compared to other forms of crypto investments. This method provides a more secure and passive approach to participate in the blockchain ecosystem a.k.a. a normal investor's wet dream.

How does a Proof-of-Stake Blockchain work ?

Many blockchains use a proof of stake consensus mechanism. Under this system, network participants who want to support the blockchain by validating new transactions and adding new blocks must “stake” set sums of cryptocurrency. Staking helps ensure that only legitimate data and transactions are added to a blockchain. Participants trying to earn a chance to validate new transactions offer to lock up sums of cryptocurrency in staking as a form of insurance. If they improperly validate flawed or fraudulent data, they may lose some or all of their stake as a penalty. But if they validate correct, legitimate transactions and data, they earn more crypto as a reward.

What is Liquid Staking ?

Imagine liquid staking as the solution to a common staking dilemma – your tokens are usually stuck and not much use during the staking period. Here's the twist: with liquid staking, the platform gives you a cool new token, let's call it Liquid Staking Token (LST), as a kind of IOU. This LST mirrors your staked amount, factoring in rewards and penalties. Think of it like putting money in a fixed deposit at the bank. While your original amount is locked up, the bank hands you an IOU that you can use elsewhere. In our case, your assets keep growing within the staking platform, and the LST becomes your go-to for transactions beyond staking. It unlocks the hidden potential of your staked assets, letting you dive into exciting DeFi applications and adding that touch of flexibility missing in regular staking.

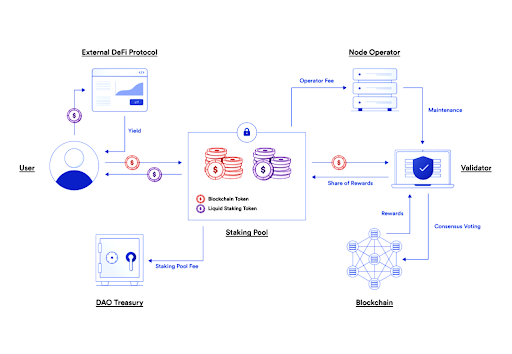

source: Chainlink

Why do we fw this

Significant advantages include the increased liquidity it offers. When traditional staked tokens are locked and cannot be used as collateral, liquid staking platforms address this issue by issuing freshly minted tokens, known as Liquid Staking Tokens (LSTs). These LSTs inherit the value of the staked tokens, providing users with the flexibility to trade or use them as collateral for other decentralized finance (DeFi) protocols.

Moreover, the composability of LSTs enhances their utility. As these tokens carry the same inherent value as the staked amount, users can seamlessly engage with other centralized exchanges (CEXs) or decentralized exchanges (DEXs). This opens up opportunities for participants to earn rewards through activities like yield farming or lending, all while benefiting from the staking rewards associated with the original staked amount.

Liquid staking also tackles the complex infrastructure requirements associated with traditional staking. Users can partake in liquid staking without the need to invest in substantial infrastructure, such as the 32 ETH required to become a solo validator in the Ethereum network. This accessibility allows a broader audience to engage in staking and enjoy the associated rewards without managing intricate technical setups.

Not all rainbows as always

Like any financial innovation, liquid staking comes with its downsides. To begin with, there is a concern regarding centralization risks in some liquid staking systems. If a few significant players control the staking landscape, it may undermine the decentralization ethos of blockchain networks. This centralization risk highlights the importance of evaluating the governance and structure of liquid staking platforms to ensure a healthy and distributed ecosystem. This has been touched on later in this article.

Another consideration is the smart contract risk inherent in liquid staking protocols. These protocols rely on smart contracts to deploy user funds into validators, making them vulnerable to attacks. It is advisable for users to trust smart contracts that have undergone rigorous testing and security assessments before deploying their funds.

Furthermore, there is a concern potential for depegging. The price of the staked derivative or stake tokens may depeg from their original value due to factors such as a lower market price of the new token or unexpected events like a sudden sell-off or hacking of the liquidity pools backing the LSTs. In such cases, users could inadvertently experience losses if their LSTs become less valuable than the assets they represent.

Centralisation? What’s that gotta do with me

Liquid staking, while offering an approach to enhancing liquidity for staked assets, introduces significant systemic risks, particularly in the context of centralization. The concentration of validation via staking within a single protocol can lead to systemic risk of centralization.

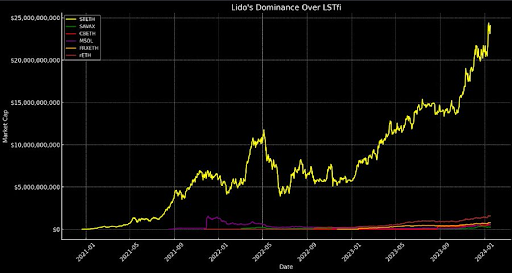

>Governance Challenges: A key concern arises from the disproportionate influence a single protocol can exert over a Proof-of-Stake (PoS) network when it holds a majority stake. This concentration of power increases the vulnerability to governance attacks, counterparty risks, and smart contract exploits. The recent example of nearly one-third of staked ETH concentrated in Lido highlights the potential consequences for validators and the broader network if such a protocol encounters issues.

>Network Security: Centralization in liquid staking introduces a threat to the fundamental properties that make Ethereum valuable - decentralization and security. The interconnectedness of node operators, whether operationally, politically, or through a liquid staking governance token, enhances the likelihood of collective actions that can compromise Ethereum's decentralized nature. This poses a risk to the core values that underpin the network's reliability and security.

This phenomenon has also been acknowledged by Danny Ryan , the lead contributor to the Ethereum 2.0 rollout and Vitalik Buterin, the creator of Ethereum himself.

>Danny’s Take: The dangers of "cartelization" in liquid staking protocols were initially highlighted by Danny Ryan in a seminal paper. The concentration of power within a single dominant liquid staking protocol can lead to undesirable outcomes, affecting not only the protocol but also the broader network.

>Vitalik’s Take: Vitalik Buterin has echoed concerns about the risks associated with a single protocol controlling a significant percentage of validators. He suggested that social pressure should be leveraged to limit any protocol controlling more than 15% of all validators, emphasizing the importance of preventing excessive centralization for the health of the network.

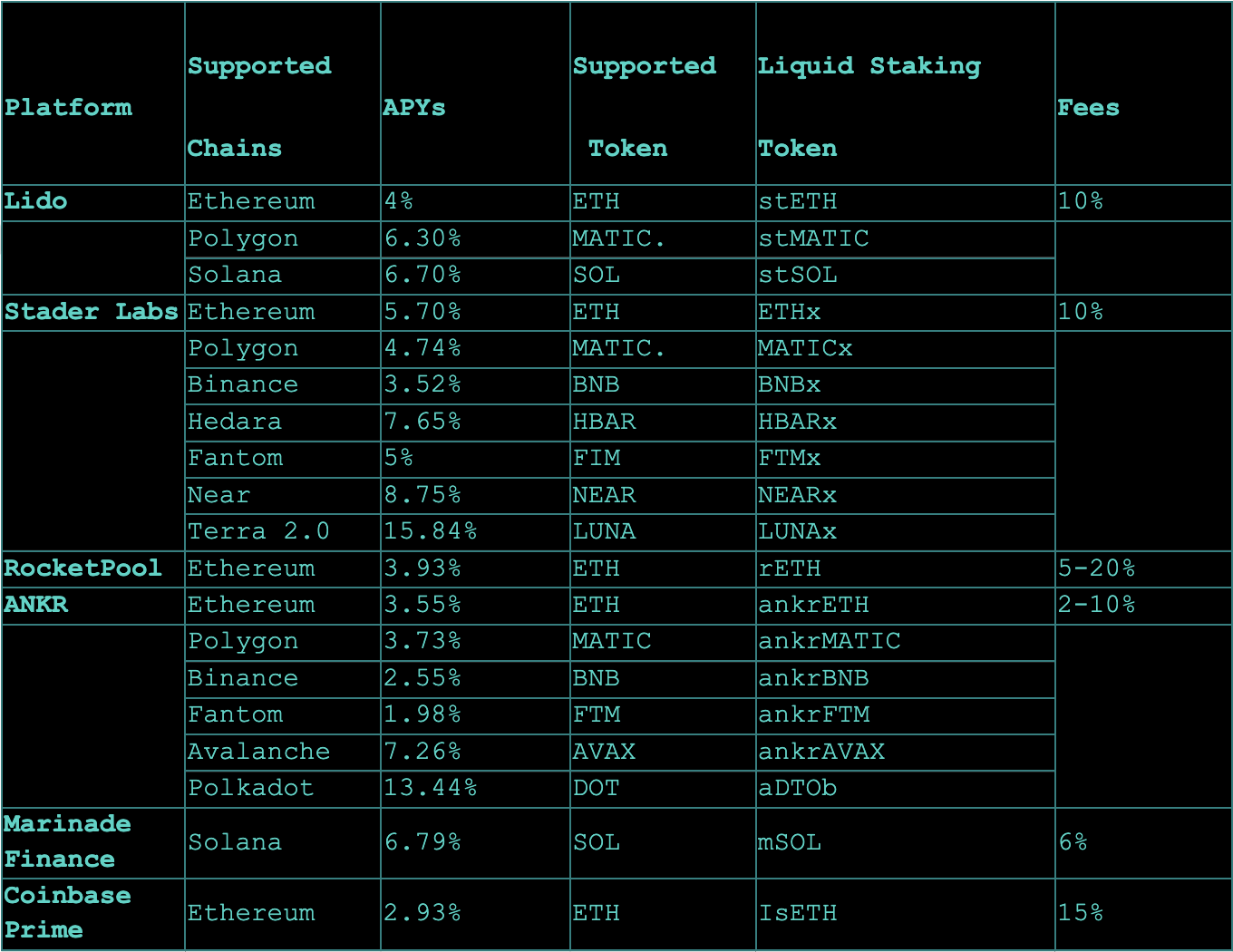

Here’s a table with popular Liquid Staking protocols available with their supported tokens, current APY and reward fees (these fees are taken on top from whatever rewards you accrue, not the staked crypto itself).

source: Milkroad

The rise to its G.O.A.T. status

>The idea for Liquid Staking was already established way back in late 2020 But it only started to take off in the mid of 2021. Going from 35 m USD in TVL to 2b USD by mid 2021.

>There were some setbacks in the growth of Liquid Staking on the way , owing to the depeg of USDT and stETH, which caused their TVL to plummet. This started with the collapse of the TerraUSD stablecoin , which caused a chain reaction of events causing the crypto market to crash. This was due to the FTX crash and the Celsius Network bankruptcy.

>Currently the Protocol with the largest market share in this area is Lido with its 23.5b USD in TVL, followed by RocketPool with its 3.1b USD in TVL.

Restaking

Crypto Noob: “So what do I do with my LST’s now ?”

“Well, you could just stake them again. And here’s how.”

>wdym: Using your LST's to stake into more networks to help enhance their security. Security in this refers to helping add more validator nodes to the side-chains using your restaked token. This is called pooled security and it amplifies the trust across more networks.

source: Obvious

>Tech behind it:This is made possible using EigenLayer , a protocol built on top of Ethereum that introduced the primitive that is restaking. It uses the staked ETH or LST's to validate the smart contracts of the protocol. Now since Ethereum cannot validate off-chain transactions, EigenLayer uses the staked ETH/LST's to create validation nodes for its AVS (Actively Validated Services) that have the capabilities to validate off-chain transactions, while maintaining the same security with the help of the Ethereum consensus layer (this is called pooled security). Now, the validators have the choice of what AVS to support and this is where you have to DYOR to find a trusted one.

>ELI5: What this jargon implies is that using your LSTs and by extension your ETH, these AVS’ can keep themselves secure and you, the user, get extra APY on your staked amount.

>ELI50: Restaking protocols make it possible for other decentralized protocols to utilize staked assets on Ethereum to improve their own security i.e. node operators can either provide services via EigenLayer or do their normal duties all while using Ethereum’s security. Validators and assets who are contracted for this purpose are rewarded according to the validator incentivization terms of the renting protocol or platform. The validator and the nominator stakers earn multiple rewards; from the parent Ethereum network and from the network or protocol they are restaked to.

LST Aggregation

Liquid staking is well-entrenched in DeFi , and will continue to grow, or stay stable, albeit its form might evolve over time. Liquid Staking Tokens build on the idea of staking, yet letting stakers maintain their liquidity, and this will be a standard in many DeFi protocols.

This directly ties into the ease-of-access of using these protocols and as can be seen, it’s not easy. Top it up with clunky UX, and you’ve got a perfect mix that works for degens, but is a maze for everyone else who are not full time crypto traders. DeFi innovation is great, but it leads to continuous fragmentation and niches, and LSTs are such.

Going ahead, there will be easy to access LST wrapper products that are structured as vaults on smart contracts and manage all the staking & restaking functions, as well as optimizing and also diversifying staking on multiple liquid staking platforms - all a user has do do is deposit Eth in the vault. Some current products which do something similar are Sommelier’s ETH Liquid Staking Vault and Locus Finance’s xETH vault, and aarnâ protocol’s â_fi vaults 700 series coming up soon are designed for easy & aggregated access to liquid staking, with restaking also managed by the vault directly.